This replacement levy request failed in February 2026. Due to the failure of the levy, BGPS will need to cut approximately $20 million for the 2026-27 school year. Learn about the process and provide input on the cuts.

On your ballot for Feb. 10, 2026

Replacement of expiring student educational programs and operations levy

At a glance

➡️ If approved, the replacement levy would have helped fund classes and programs that give students the tools for today's economy and prepare them for their future careers.

Levy dollars would have helped to maintain current career and technical education classes and programs. They also would have helped to maintain classes that prepare students if they are going to college.

Levy dollars would have paid for curriculum that is up to date and addresses the knowledge and skills that students need to enter the workforce.

➡️ A replacement levy would have provided funding to bring back teachers and staff to return to smaller class sizes.

➡️Battle Ground Public Schools is the only Southwest Washington school district without an educational programs and operations levy.

➡️ All registered voters who live in the district were eligible to cast a ballot.

What the levy would have paid for

If the levy had been approved, every Battle Ground school would have received levy dollars. The replacement levy would have funded:

Student safety

Crossing guards

Assistant principals

Counselors

Smaller class sizes

Special education

Teachers

Nursing

Mental health support

Career readiness

Sports / extracurricular activities

If approved, the levy also would have returned some, but not all, of the student support positions and programs that were cut after levy failures in 2025.

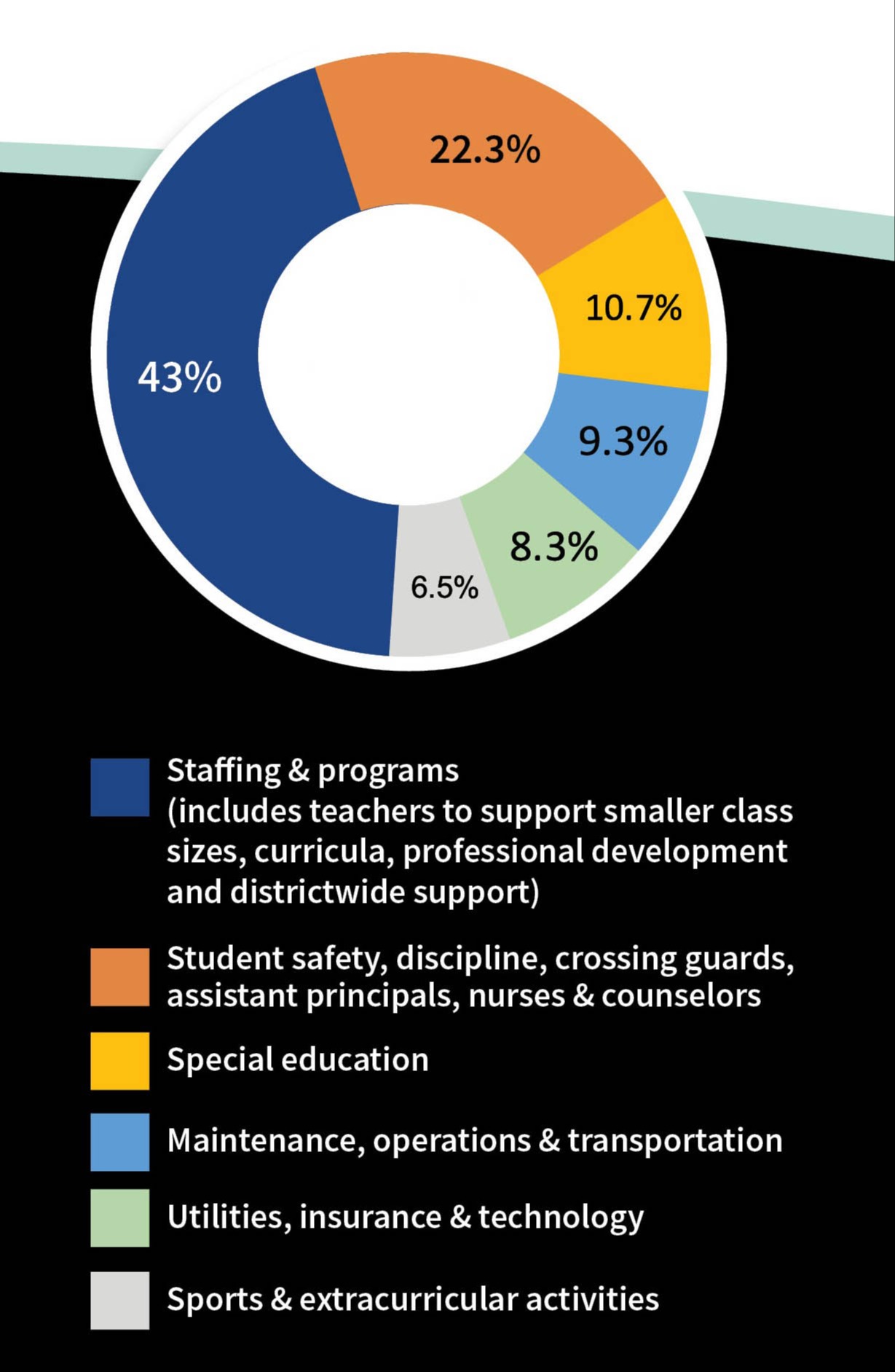

How levy dollars would be used

Percentages have been rounded. Click to enlarge.

Levy dollars would have helped maintain current career and technical education classes and programs.

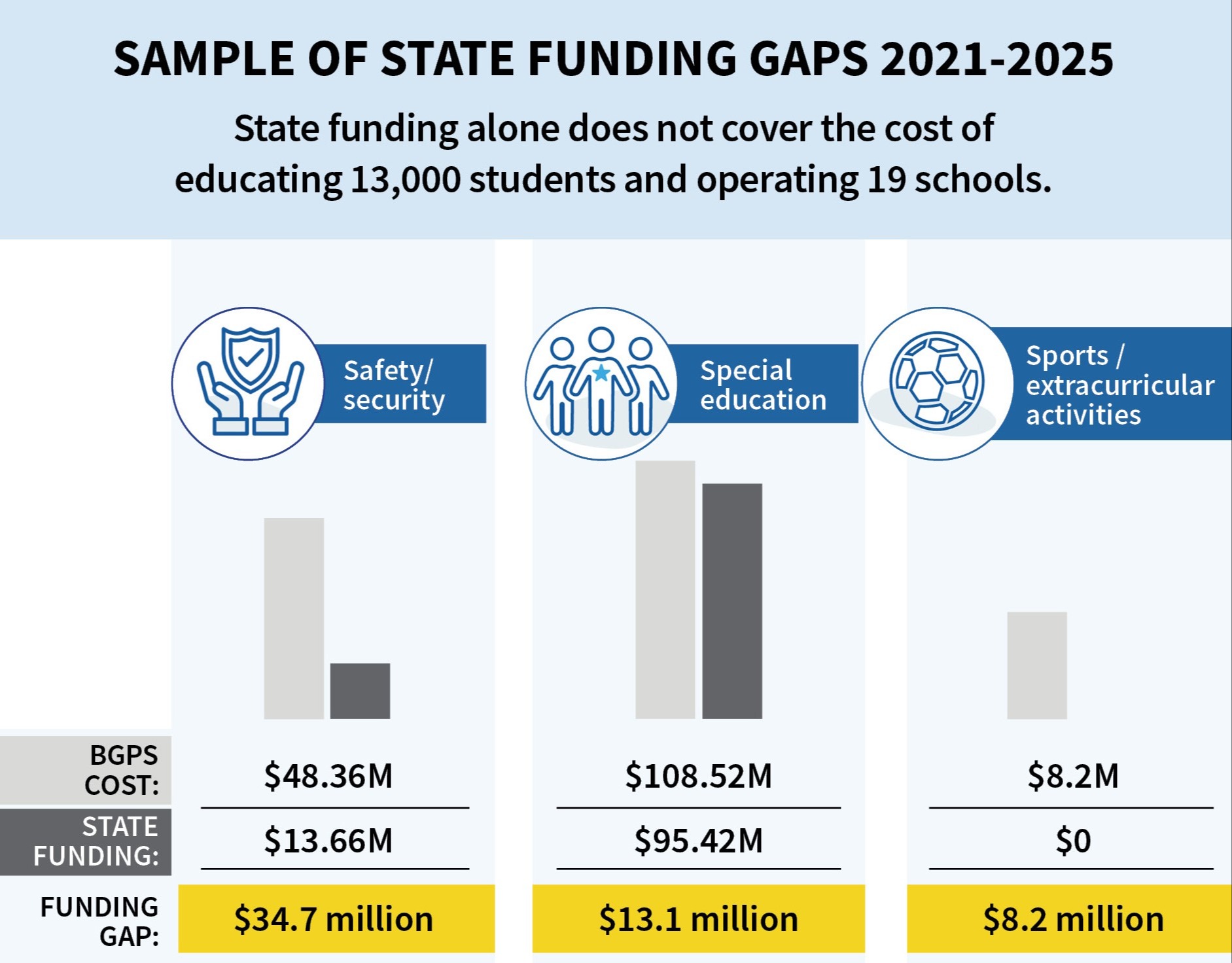

State funding gaps

Levy dollars could have made up the difference between what the state provides for basic K-12 education and what it costs to educate 13,000 students and operate 19 schools. Over the last four years, Battle Ground Public Schools has been underfunded by millions.

State funding on the decline

As Washington state’s operating budget has increased, the percentage that goes toward funding K-12 education has decreased. In 2019, 52.4% of the state’s budget was dedicated to K-12 education. By 2024, it had decreased to 43.1%.

Click to enlarge

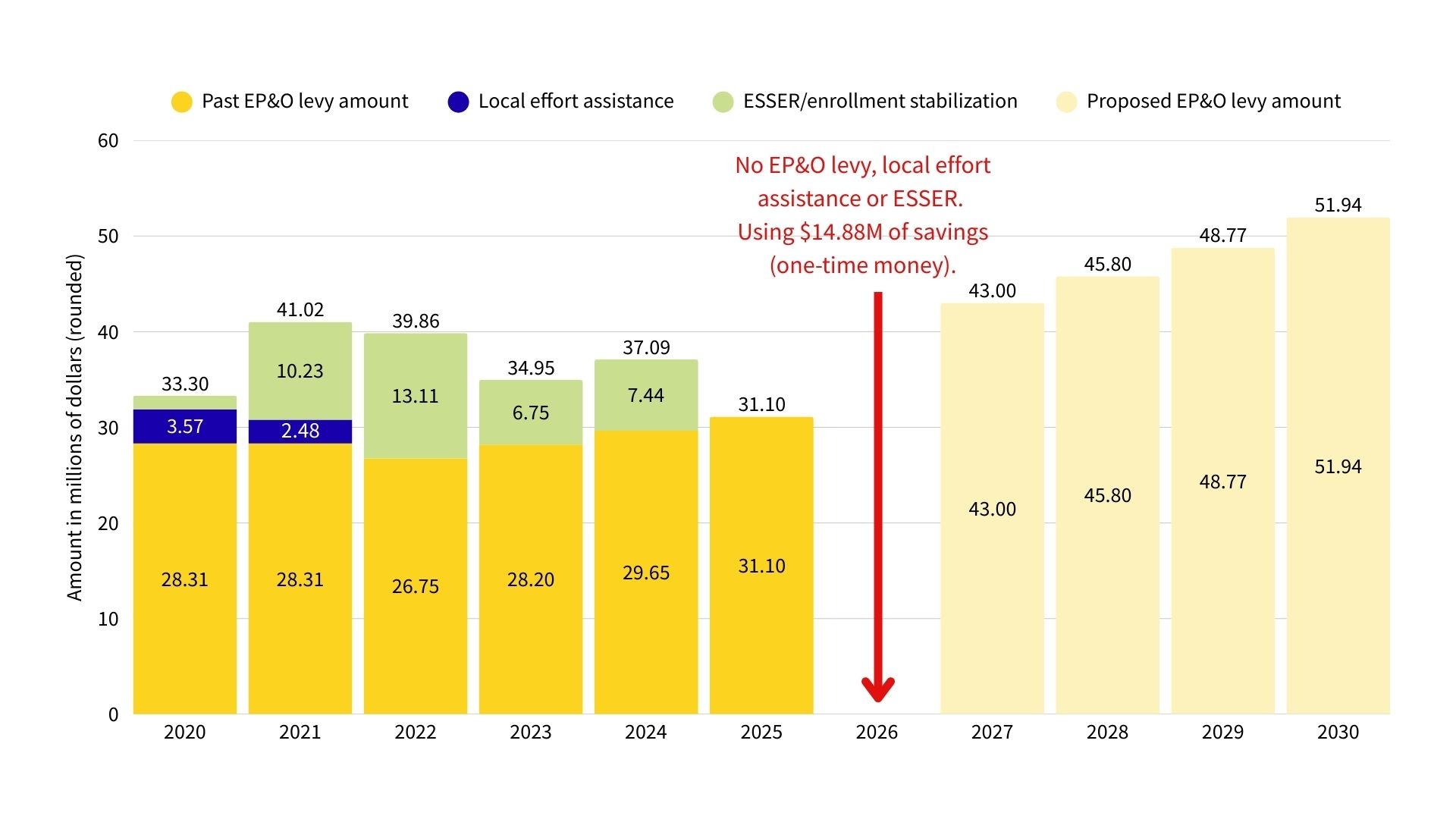

How much the levy would have collected

The district cannot collect more than the approved amount each year. Property value increases and new residents do not generate more education and operations levy dollars for the district. An approved replacement levy would have collected the following amounts:

$43 million in 2027

$45.80 million in 2028

$48.77 million in 2029

$51.94 million in 2030

How was the proposed amount set?

In determining the proposed amount, district leaders looked at student enrollment, state funding gaps, rising operating costs, lack of other funding sources and the district's reserves/savings account.

Student enrollment: Between the 2021-22 and 2024-25 school years, student enrollment increased from approximately 11,885 students to 13,080 students. It is projected to continue to increase.

State funding gaps: The gaps between state funding and what it actually costs to educate students have been widening in recent years.

Rising operating costs and unfunded mandates: These have contributed to an increase in the district’s expenses. Just a few examples of rising costs include:

State-mandated but unfunded transportation contractor benefits: +$2 million (in 2026-27)

Water rate increase: +$20,000

New sales tax requirements: +$250,000

Utilities: +$514,000 (between 2019 and 2024)

Risk insurance: +$98,000 (between 2019 and 2024)

Lack of other funding sources: Battle Ground no longer receives state or federal money that helped the district maintain operations during the pandemic. Those funds ended in 2024.

District reserves/savings account: Battle Ground Public Schools is using $14.88 million of one-time money in its fund balance (reserves/savings account) to sustain operations in the current school year. That money will not be available to use in future years.

Click to enlarge

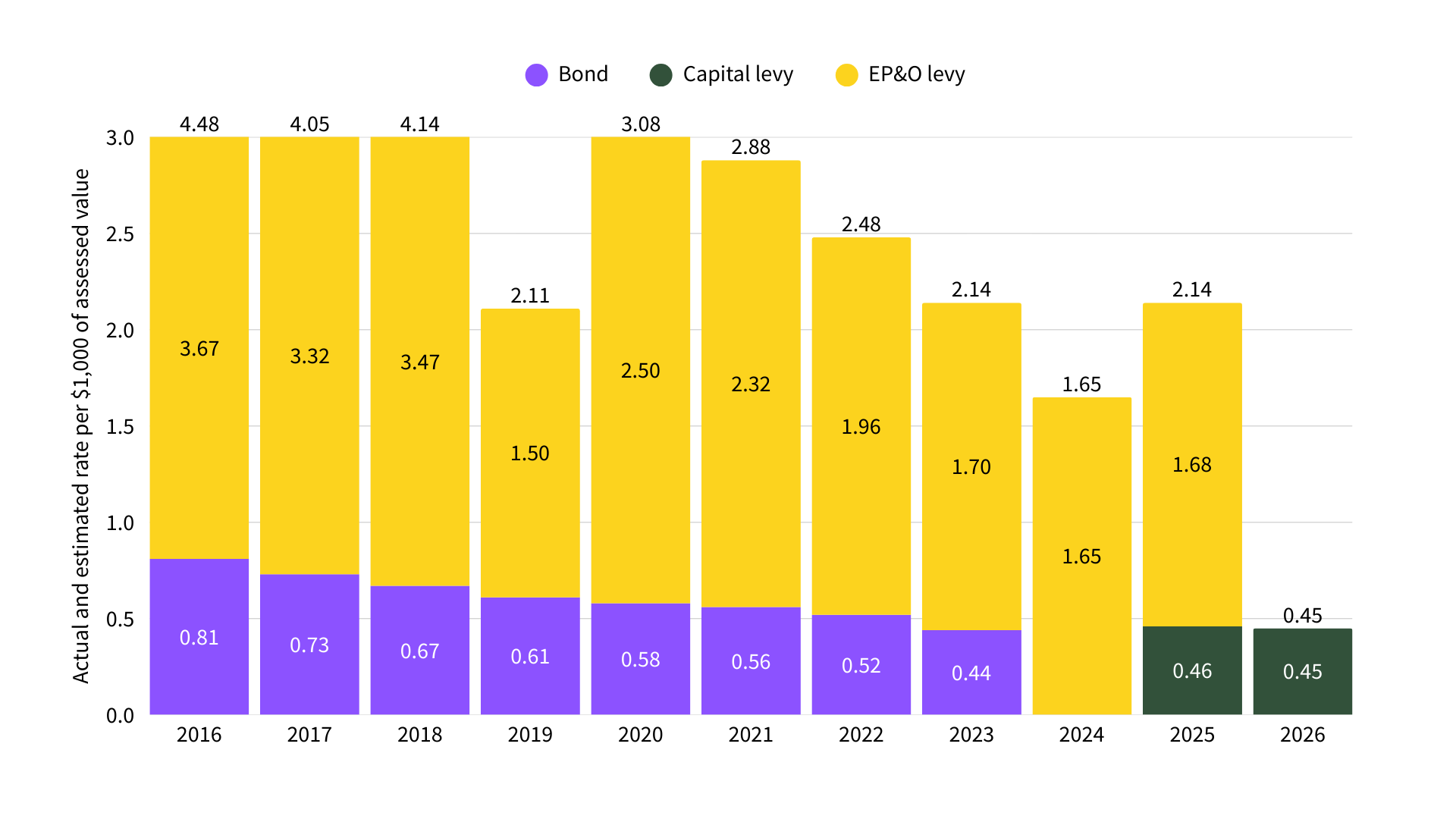

What the levy would have cost property owners

Estimated rates were provided so that property owners could calculate the potential tax impact. The estimated rate was $1.99 starting in 2027 and continuing through 2030.

The actual rate would have been affected by the amount of new construction within district boundaries. By law, however, the district can't collect more than the amount that voters approve, even if property values increase.

Battle Ground's tax rate has actually decreased dramatically over time.

How the total local rate would have compared to other districts

*If replacement levy had been approved. Battle Ground's rate includes a capital levy expiring in 2027.

Enrollment based on most recently available number on the Office of Superintendent of Public Instruction report card at the time of posting.

Tax rates are per $1,000 of assessed property value and do not include state taxes for schools. The rates are estimates for 2027 based on district projections or current rate available. Actual rates will vary.

How I can learn more

The community presentation on Jan. 14 has passed.